Additionality in focus: Our approach

Infra Bank in Focus

Additionality in focus: Our approach

31 October 2022

By Urvashi Parashar, Chief Impact Officer and Chief Economist

Infrastructure improves access and connectivity between people and places, be it energy, transport or broadband, and it can boost living standards, create good jobs and skills, and attract investment.

Roughly 100 days ago, I took up the role of Chief Impact Officer / Chief Economist at the UK Infrastructure Bank. I joined the Bank at an exciting time in its journey as we launched our strategic plan and successfully completed around six deals. I was particularly drawn to the fact that the Bank is clearly positioned to, through its capital and links to policy makers, have a material impact on the country’s climate goals, and on regional and local economic growth, the two missions for the Bank. My last role was ensuring the UK’s Levelling Up Whitepaper was grounded in the best evidence on how to boost regional and economic wellbeing across the UK. It’s fair to say I relish the challenge of turning this theory into practice at the bank.

Turning theory into practice also means the Bank must be thoughtful about how it uses its £22bn of capital, ensuring we use public resources wisely where government or the financial sector aren’t best placed to make things happen. But we need to go further and check that what we make happen is indeed down to us. We, and HM Treasury’s ‘Green Book’ guidance to economic decision making using public money, call this additionality.

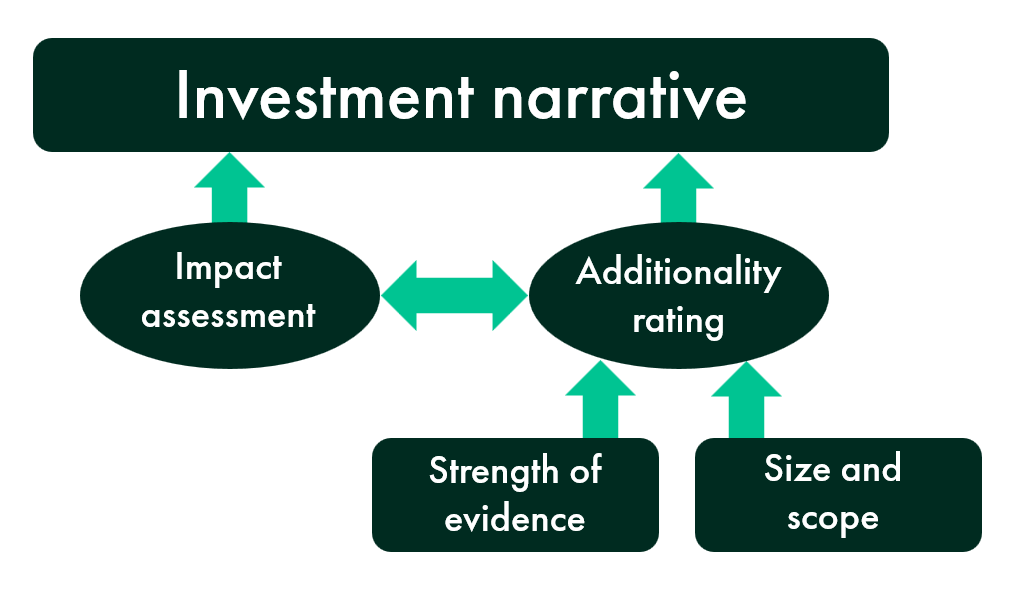

In very simple terms, additionality is the extent to which, what happens because of our support, would not have happened otherwise. We are publishing our approach today to provide more detail on how we understand, test and demonstrate the additionality of our private deals, ex-ante, i.e. before the decision to invest. A sound approach to additionality is needed to ensure that our decisions are credible and defensible to the public.

To do this well, it is important that we go back to first principles. Our investments must have the intended impact on the outcomes we most care about, the UK’s climate goals and regional and local economic growth. We must also be confident that this impact can either be attributed to our actions, or something we have contributed to. We would have to understand the counterfactual – what would have happened if we had not intervened? Would the project have gone ahead, or happened at a slower time, or a smaller scale?

We can be additional in different ways, not only through UKIB finance. We could be offering a unique product, accelerating projects, or scaling up investments. It can also include improvements to material environmental, social, resilience and governance (ESRG) considerations of a project. Additionality can come from our activities (the finance itself), the outcomes we secure (e.g. creating jobs) and behaviour we change (e.g. reporting requirements).

Our approach includes minimum evidence requirements, and a process where every deal is assessed and rated on a case-by-case basis to identify whether it credibly demonstrates additionality, to aid robust decision making at our Investment Committee. I am under no illusion that additionality is a judgement, and not a precise science. Testing what would have happened without us before a deal happens is especially tricky. And yet a sound judgement must be grounded in good quality evidence from multiple sources. We will also be evaluating our approach.

We are a new and learning organisation. So, while we have a clear view on how we are going to test and judge additionality of the Bank’s investments, we also know that we must continue to review and iterate our approach over time, as we build our expertise in this space. I look forward to taking this journey with you.

Related information

You may also be interested to read our guidance on how the Bank assesses the additionality of all its private deals before the point of investment decision.